Residential status of an individual will cover the financial year of an individual and as well as hisher previous years of stay. This full style occurred commonly as a diplomatic rank for the head of a mission ranking just below envoy usually reflecting the relatively low status of the states of origin andor residency or else difficult relations.

Question 1 How Is An Individual S Resident Status Determined Under The Income Tax Act 1967 As Amended Question 2 State Advantages Amp Course Hero

Ppt Chapter 2 Resident Status For Individuals Powerpoint Presentation Id 6980906

.png)

Mygov Managing Personal Identification Acquisition Of Citizenship

A resident in Malaysia and does not intend to seek residence status in Malaysia.

.png)

Resident status in malaysia. However Canadian authorities decide residency status on a case-by-case basis. Applicants are advised to keep track of the OCI status in the Online Status Enquiry. So for those that fall under the non.

My company is not resident in. If the Applicant gives incorrect inaccurate information amendment cannot be made and applicant has to re-apply the. You can still have a Canadian bank account credit cards and rental property in Canada and have non-resident status.

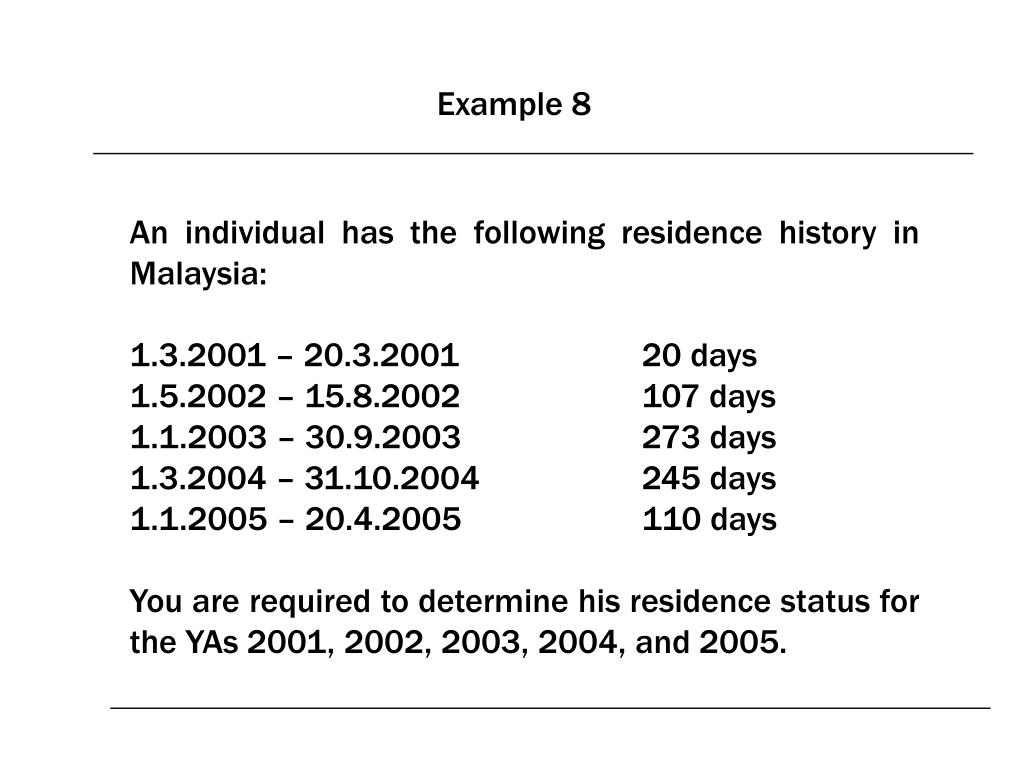

A company whether resident or not is assessable on income accrued in or derived from Malaysia. A resident company engaged in manufacturing or agriculture that exports manufactured products. Resident Individuals who do not carry on businesses can submit their e-BE Year of Assessment 2020 via MyTax.

On occasion the resident ministers role could become extremely important as when in 1806 the Bourbon king Ferdinand IV fled his Kingdom of Naples. LHDNM is prepared to presume that the company is not a Malaysian resident if the company is required to hold BOD meeting in Malaysia due to COVID-19 travel restrictions. Enter phone number like 1234567890 or 123-456-7890.

India and the US are liable to pay tax by reason of domicile residence citizenship place of management place of incorporation etc. Be a permanent resident of Canada. Resident ROR Resident but Not Ordinarily Resident RNOR Non Resident NR 1.

150 Last Update. YA 2021 and YA 2020. This is usually for a permanent period.

Original or copy of your US Permanent Resident Card or any other documents verifying your status in the US. Non-resident working in Malaysia. An expired Permanent Resident Card with a two-year validity and a Form I-797 Notice of Action indicating that status is extended If you have an expired Green Card with a 2-year expiration date AND a Form I-797 Notice of Action showing that they have filed a Form I-751 or Form I-829 to remove the conditions on their permanent resident status the Form I-797 extends the validity of the.

Income derived from sources outside Malaysia and remitted by a resident company is exempted from tax except in the case of the banking and insurance business and sea and air transport undertakings. Residents and Non-Resident status will give a different tax regime on income earnedreceived from Malaysia. I am a Singapore-based Singapore CitizenSingapore Permanent Resident holding a Malaysia Work Pass.

In cases where the client is under 18 years of age all legal guardians must consent in. Am I eligible for a PCA pass to return to Malaysia for businesswork. Entry into Malaysia is subject to approval and Immigrations vetting.

Have citizenship or valid legal permanent resident status in another country. So it is very important to identify whether you are Residents or Non-Resident in regard to Malaysia Tax Law. Please submit your original Passport PIO card if any and receipt between 1130hrs to 1230hrs.

Permanent residency is a persons legal resident status in a country or territory of which such person is not a citizen but where they have the right to reside on a permanent basis. You can collect your OCI card between 1630hrs to 1700hrs the same day. The e-Filing system will be opened from 1st March 2021 and the submission deadline for e-BE YA 2020 is on the 30th April 2021.

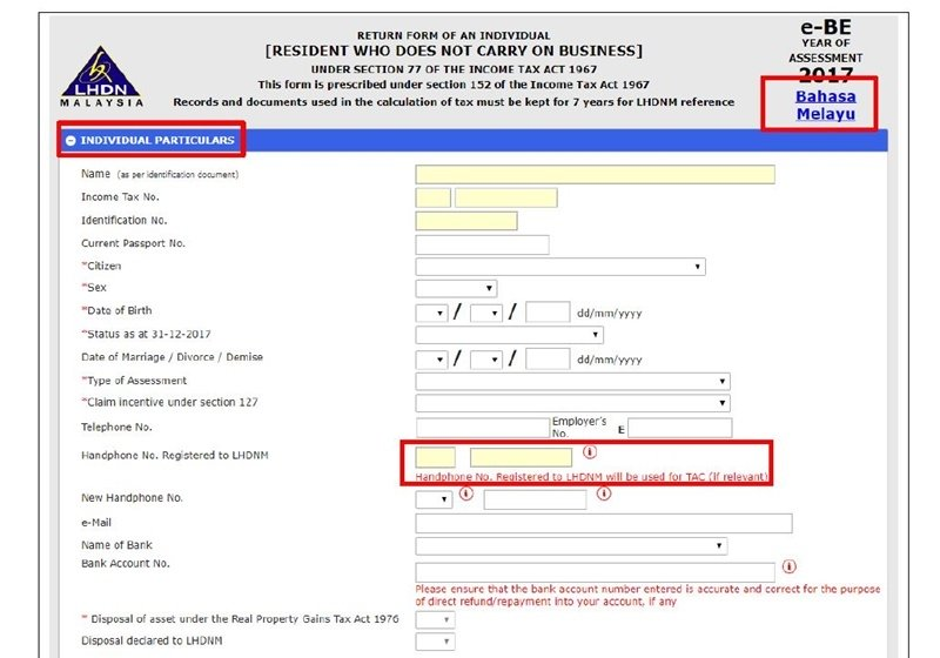

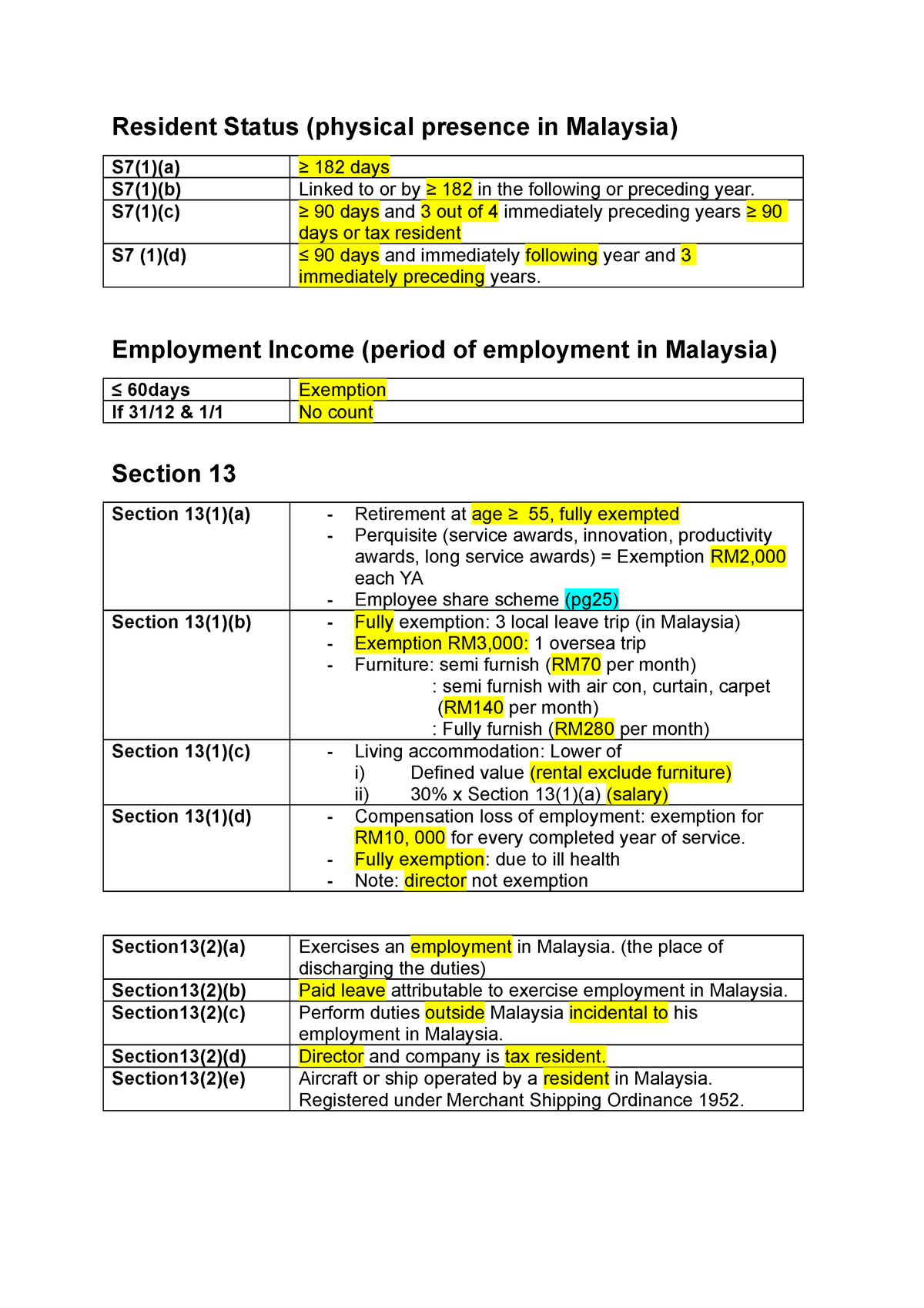

Yes you are eligible to work in Malaysia under the PCA scheme. An Individual will be. You are considered as a non-resident under the Malaysian tax law if you stay less than 182 days within Malaysia within a calendar year regardless of your citizenship or nationality.

MyTravelPass with the Malaysian authorities. If they deem you to still have significant ties to Canada you will be a resident for tax purposes. Unless they are citizens of a visa-exempt country individuals who wish to enter Canada for a temporary purpose must apply for and be granted a Temporary Resident Visa TRV.

The residential status of a person can be categorised into Resident and Ordinarily Resident ROR Resident but Not Ordinarily Resident RNOR and Non-. However you are required to apply for entry approval ie. A person with such legal status is known as a permanent resident.

MSC Malaysia status is awarded to both local and foreign companies that develop or use multimedia technologies to produce or enhance their products and services as. Under Malaysian Tax Law both Residents and Non-Resident are subject to Income Tax on Malaysian source income. Approval granted is only for SINGLE JOURNEYApplicants who wishes to exit the country DO NOT need to apply for permission to leave the country.

A fee of US 1800 in cash or money order made payable to Consulate General of Malaysia. Two 2 recent passport size photographs. In the United States such a person is referred to as a green card holder but more formally as a Lawful.

To renounce your status as a permanent resident you must. There are the following categories which classified the residential status of an individual. Resident and Ordinarily Resident ROR.

Certified true copies accepted ONLY from Malaysia if obtained from. Where it is a dividend income paid by a Singapore company to a Malaysia company or resident owning a minimum of 10 voting rights in the paying company Malaysia shall take into account Singapore tax payable by that company in respect of its income out of which the dividend is paid but the credit shall not exceed that part of the Malaysian tax chargeable as computed before the credit is given. According to the Income Tax Act 1961 residential status of a person is one of the important criteria in determining the tax implications.

The assessing officer refused to grant the status of not ordinarily resident because during the last 9 previous years the assessee was non-resident for only three years and during the last seven previous years he had stayed in India for a period of 1402 days. Headquarters of Inland Revenue Board Of Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. Game Bundle Resident Evil Village Resident Evil 7 Complete Bundle PS4 PS5 Simplified Chinese English Korean Thai Japanese Traditional Chinese -35 RM 21385 RM 32900.

Must enter area code. 1 514 937-9445 or Toll-free Canada US 1 888 947-9445. A Resident refers to a person who as per the relevant laws of the Contracting States ie.

The approval is not given automatically. How to Submit Check MyTravelPass Application Status Many of you may know that Malaysia Immigration requires an approval letter of DG Immigration before entry or exit to the Malaysian border to prevent the spread of Covid-19.

Malaysia Taxation Of Cross Border M A Kpmg Global

Rhbgroup Com

What Is The Scope Of Charge To Tax Of A Resident Individual Under Income Tax Act 1967 2 What Is Income 3 State The Classes Of Income On Which Tax Course Hero

F6 Taxation Residence Status Part 1 3 Youtube

Malaysia Personal Income Tax Guide 2020 Ya 2019

Acca Advance Tax Resident Status Physical Presence In Malaysia S7 1 A 182 Days S7 1 B Studeersnel

Are You A Tax Resident In Malaysia Do You Need To Pay Tax

Expansion Of The Periodic Commuting Arrangement Pca News From Mission Portal